Invoice Management

Invoice management is the process that places the management of the entire commercial credit cycle at the center of the procedure, from its origin (acknowledgment of the customer) to its closure (collection).

MyCreditService is a solution that combines management efficiency, transparency towards the market and advanced valuation algorithms, in a logic in which commercial credit is managed in a structured way, with a clear vision of customer risk, an effective credit policy and direct facilitated access to the market of institutional investors.

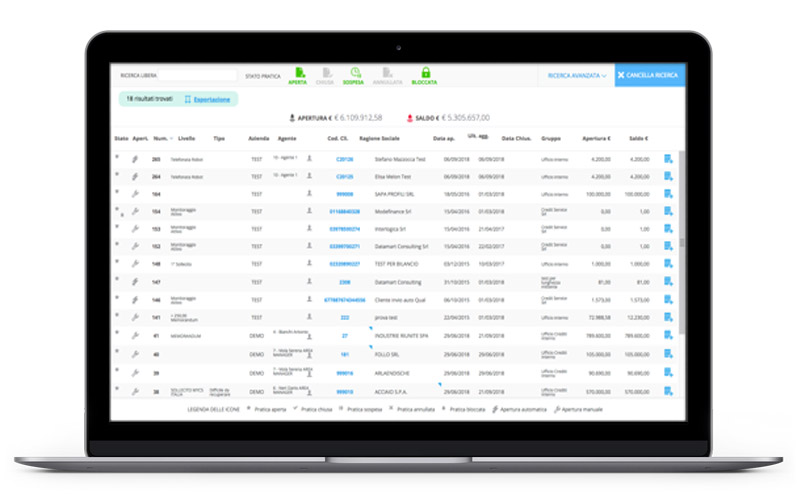

Risk analysis

The first step for an integrated management of trade credit is an in-depth analysis of the existing and prospective risk, based on its customer base.

MyCreditService provides an always-updated representation of the exposure to customers by using data from the company, which are imported in real time from the management system quickly and effectively, and subsequently crossed with commercial information and credit scoring. The result is an analysis dashboard organized by rating classes and credit aging, thanks to which it is possible to constantly monitor one’s own risk profile and exposure throughout the year and to manage the dynamics.

Credit valuation

Improving the quality of commercial credit and the collection times of our customers is the main goal of us at MyCreditService.

But thanks to the use of the platform, companies can obtain a more careful and timely evaluation of their credits. This is possible thanks to a highly innovative rating algorithm, capable of providing a constantly updated picture of the trend in working capital. The result is an updated assessment of the credit quality and its “value” on the market, which is thus assessed in real time with a view to subsequent placement on the marketplace.

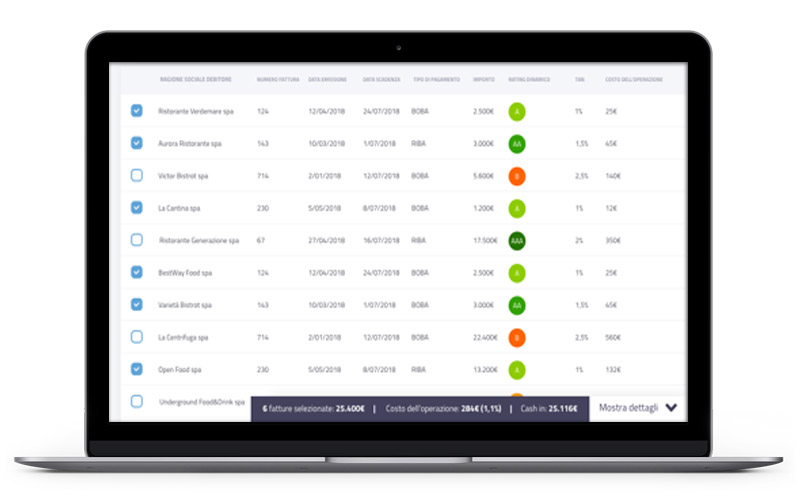

Invoice trading

Within MyCreditService, the phase of trading credits on the marketplace therefore takes place only downstream of a process. In this process the value of the credit to be placed is defined in a clear and transparent manner. It is the product of historical data of the transferor and assigned and of updated data relating to the real dynamics of collections and payments between customer and debtor.

This means: for the transferring company to immediately realize the feasibility of the operation and the related costs, and for the investor to have an investment memorandum with constantly updated performance data and an investment grade portfolio prepared by an external rating agency.

Credit collection

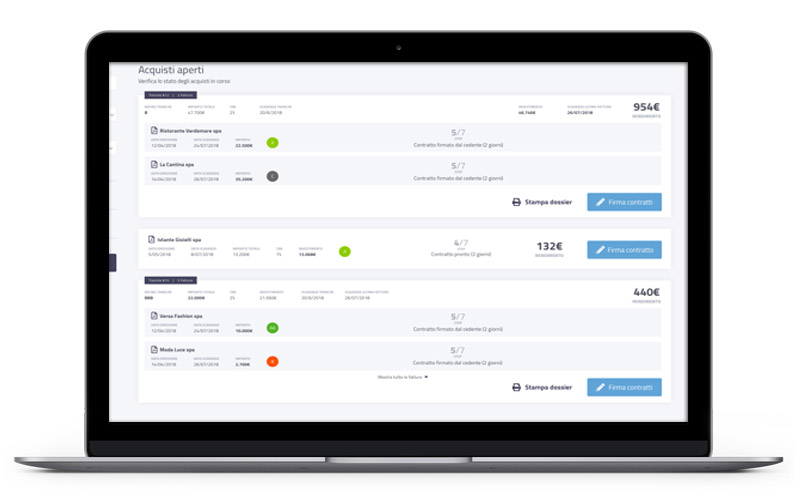

As credit managers, companies and investors know, the commercial credit cycle ends only with the collection by the customer and the eventual repayment of the advance.

The MyCreditService platform therefore also oversees this last delicate step, with an operational workflow that allows you to track and automate the entire corporate credit policy.

E-mails, reminders, registered letters, certified e-mails, telephone calls are then carried out automatically or “on command”, based on the policies defined by the company for individual customers or for clusters of customers.

This means for the company to significantly improve the collection performance (+ 20% per year, the average users of the platform) and for the investors to have the guarantee of accurate management of any outstanding payments both in the out-of-court and judicial phase.

Find out how we can help you